This piece (originally published on Medium) seeks to cover the emerging trend of “aggregators” within decentralized finance on Ethereum. First coined in 2017, DeFi has grown enormously since inception, unbundling the financial stack into an open, permissionless system. I will highlight the modular nature of the DeFi stack, and the role of aggregators.

In December 2017, MakerDAO launched Dai, a crypto-collateralized stablecoin built atop the Ethereum network. The Maker team has in many ways been the darling of DeFi, as Dai and Maker’s tooling have served as core building blocks for DeFi. Dai’s endured USD-peg as the price of Eth plummeted from $1400 to $80, encouraged trust and secured its role as the medium of exchange for DeFi.

A particularly interesting trend in DeFi is the shift to aggregators, the user facing products that are built atop decentralized infrastructure. Aggregators emphasize UX/UI improvements over the liquidity layer, whereas the liquidity layer is singularly focused on improving the core underlying functionality (lending, exchange, etc).

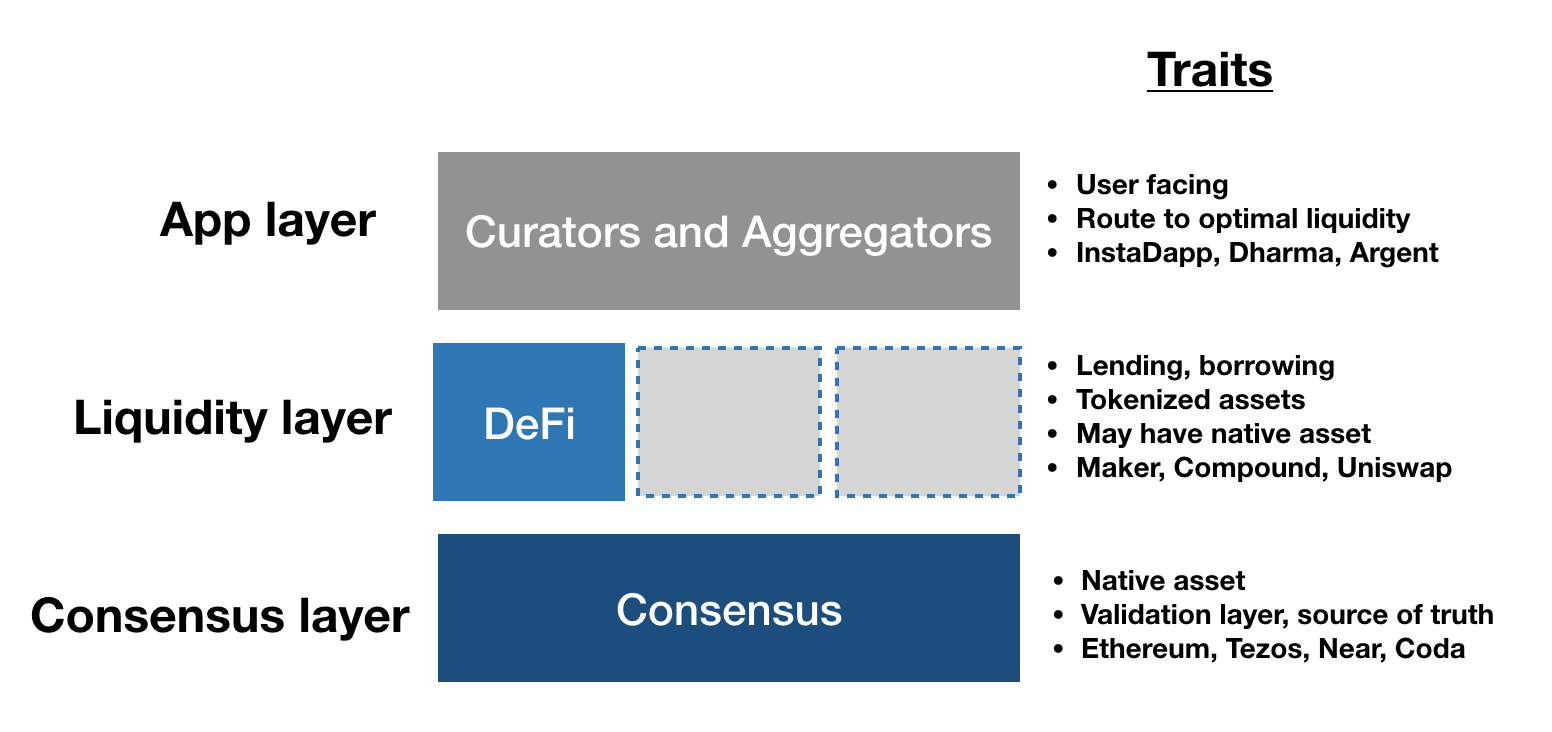

For framing, I’ve visualized the modular nature of DeFi below. The consensus layer (ie Ethereum) serves as the digital economy powering the two layers that sit atop: the liquidity layer, and the application layer. Worth noting is the open, permissionless nature of the the liquidity layer compared to closed web2 APIs. As you will see, the aforementioned ‘aggregators’ are within the application layer, since they are the last piece of the puzzle in delivering crypto-network enabled products and services to end users. This open, unbundled financial stack is being accelerated by DeFi tooling, which will be covered later in the post.

Liquidity layer

Examples: Maker, Compound, Kyber, Uniswap

The liquidity layer often uses “Eth locked in DeFi” as its KPI, which stands at an aggregate ~$500M worth of Eth at the time of this writing. MakerDAO Collateralized Debt Positions (CDPs) are the most active source of locked Eth, underpinning newly minted Dai. As CDPs are opened (and Eth is locked in a smart contract) Dai is minted, and as CDPs are closed, Dai is burnt or destroyed.

Maker, Compound and Uniswap are the three largest liquidity protocols within the layer, serving aggregators and crypto-savvy users directly. Liquidity layer smart contracts are permissionless and open source for any 3rd party (entity or individual) to use — you can think of using the liquidity layer as an API, without having the API owner’s consent. As the liquidity layer gains traction, network effects increase, leading to more competitive spreads and rates. In the context of lending, more liquidity at scale allows better rates or essentially more access to cheaper credit as lenders receive lower interest if supply outpaces demand.

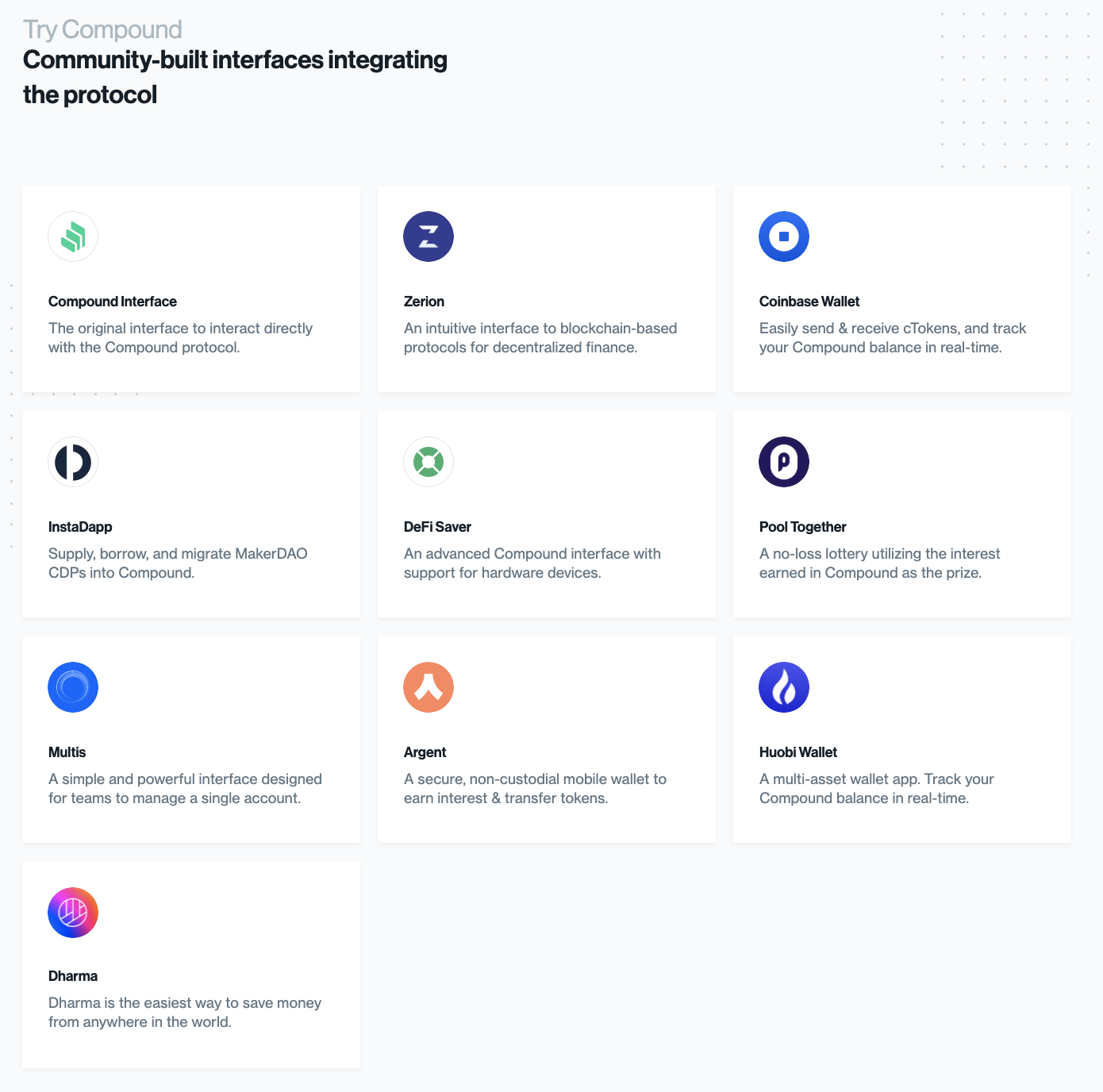

Compound and others at the liquidity layer have built out user facing applications, yet also promote an array of aggregators (Argent, InstaDapp, Zerion) for access, as seen by Compound’s homepage above. There is a possibility that those at the liquidity layer expand their own user facing product efforts, or build out their own tooling (as DyDX recently introduced their own market making) — yet the DNA of building robust, crypto infrastructure at the liquidity layer is quite different than the DNA of building elegant, frictionless applications and aggregators. To this point, Dharma, which originally set out to build its own protocol and user-facing application, recently pivoted to pure aggregator status and offers end users liquidity from Compound.

Aggregators

Examples: Instadapp, Argent, Ambo, Zerion, MetaMoneyMarket, Multis, Topo Finance, DeFi Saver, Guesser.

Aggregators are tapping into DeFi liquidity to serve end users, and allow DeFi liquidity to expand beyond crypto-savvy users. Aggregators put UX/UI first, offering a far improved experience than interacting directly with the liquidity layer, thus allowing a first-class holistic experience.

Looking back, early aggregators in Ethereum were relayers like Radar Relay, which aimed to serve a more intuitive user experience than interacting directly with 0x. Relayers improved the user experience for decentralized exchanges, notably for contract fillable liquidity.

Today’s aggregators are working with far richer liquidity, and taking more user-friendly measures to bridging DeFi liquidity to the masses by abstracting gas fees, being mobile-first, and sometimes obfuscating private keys from users. As seen below, Argent leverages Compound and MakerDAO at the liquidity layer, and serves users with an elegant, mobile-first, smart-contract wallet.

As DeFi liquidity grows, aggregators will expand accordingly to serve better user experiences- an example being a savings account application, where users simply deposit USD and see interest accrual but are not exposed to underlying DeFi smart contracts or crypto-networks. Under the hood, that USD would be immediately converted to Dai, and a smart contract will route Dai to the highest yielding interest DeFi protocol.

In time, aggregators are positioned to be able to tap into centralized liquidity from the likes of BlockFi, Coinbase, and CoinList as these companies weigh opening up APIs beyond their own users.

Also, as aggregators serve users, they will be well positioned to tap into liquidity beyond Ethereum’s DeFi ecosystem, say from Tezos or Near. Aggregators will be the biggest driver of “interoperability”, allowing end users to access Tezos or Near DeFi if rates are more competitive than Ethereum DeFi (fwiw Ethereum is not AOL of crypto). With power comes responsibility, and aggregators will have to decide whether to market fixed or variable rates (in the savings account example), while also navigating the regulatory landscape.

Ultimately, aggregators may commoditize the liquidity layer in a similar vein to Ben Thompson’s Aggregation Theory as they define the user experience and control distribution — this will not happen meaningfully in the short term as aggregators are emerging and remain quite reliant on the liquidity layer (ie lending/borrowing rates). As aggregators emerge and reach larger audiences, we may see increased efforts by aggregators to fork the underlying liquidity layers — it is too early to say, and for now I defer back to liquidity layer vs. aggregator DNA comments earlier.

Tooling

The burgeoning trend of aggregators would not be possible without liquidity, but just as important, the tooling tangential to our DeFi stack earlier. Tooling has accelerated development of the application layer, enabling applications to plug and play versus building out their own liquidity, stablecoin or other crypto-native infra.

I’m excited to see more entrepreneurs experiment with tooling and DeFi’s modular and open liquidity: pooled lotteries, DAOs, and tontines are opportunities to disrupt geographically constrained, centralized offerings.

Conclusion

Ethereum DeFi liquidity and tooling is improving by the day, and its open and modular nature allows anyone to build aggregators, and use-case focused applications. This is possible on Ethereum today even at its current 12–15 transactions per second, and aggregators will hopefully have an even larger sandbox as new digital economies launch, the liquidity layer grows, and with improvements on tooling.

The path forward for aggregators is not linear, and they will be tasked to navigate the modular nature of DeFi — decentralized and open, yet potentially hazardous from black swan events that may corrupt the entire system. Some have called DeFi a house of cards, given the extreme reliance on Dai, potential oracle attack vulnerabilities, and centralized backdoors of DeFi protocols.

I am optimistic that DeFi’s modularity will not be its Achilles Heel, and the world is on the edge of of a globally accessible, permissionless system with Ethereum leading the charge. To conclude, I predict locked Eth will 2x from here by year’s end ($1B+ here) by December 2020 with aggregators serving the majority of the liquidity layer to end users.

Special thanks to Hart Lambur, Clay Robbins, and Katherine Wu for feedback on this piece.

Open Questions

If aggregators are main beneficiaries by owning users, who will maintain DeFi protocols? MakerDAO’s governance token, MKR seems to be a good model for incentivizing protocol participation and I suspect many liquidity layer protocols are considering their own governance, or dividend-esque token.

Business models, without getting into regulatory grey area is unclear for the liquidity layer. Projects that have a valid token economics argument where usage accrues to liquidity layer’s native token seem to be most interesting (similar to #1).

What happens when a future Ethereum upgrade breaks existing contracts at the liquidity layer? This seems to be a huge headache, and it will happen. This also limits how perpetual DeFi products can be. (You can’t build a 100yr asset on Ethereum right now because it will 100% break on Eth2.0)

What happens if a single liquidity layer’s network value or aggregators AUM grows larger than the value of their underlying digital economy (ie MKR’s network value exceeds ETH’s network value)?

Will DeFi rates outperform centralized offerings? In theory, DeFi should offer better rates than centralized offerings as middle-men are cut out, and liquidity is a competitive marketplace yet Eth interest on BlockFi (3.3%) is more competitive than DeFi offerings today (<1%).

Network effects at the liquidity layer can be real, and it’ll be hard to build another Compound given the liquidity head start. BUT, prices/spreads matter here… if Compound charged a lot, it in theory could be forked and liquidity migrated to the cheaper version.